How much is $45,000 a year hourly? A common pitfall freelancers encounter is an error in calculation by merely dividing hours worked in a year with their expected annual income. Here’s what you should actually consider when setting your hourly rate.

Full-time employees have salaries that cover a wide array of business costs, including licensing, taxes, health care, and various business essentials. The same cannot be said when you are your boss. As a freelancer, you must cover all the costs of that and more.

🚀 Kickstart Your Freelance Journey! 🚀

Discover the best platforms handpicked by our experts to supercharge your freelance career. Trusted by professionals worldwide, these platforms are essential for every freelancer.

Dive into a curated list of premium remote and flexible jobs. No scams, just genuine opportunities.

Explore FlexJobs

Say goodbye to endless job hunting. Receive top 1% of freelance jobs in your inbox.

Discover SolidGigs

With advanced AI, get matched with jobs that resonate with your skills and passion.

Join ZipRecruiter

Connect with global clients, showcase your portfolio, and bid on projects that align with your expertise.

Start on TopTal

Even if you charge a flat rate or value-based, freelancers need to know their annual pay and minimum hourly rate to understand how much their service is valued for time spent working. But what’s the best way to start? Let’s discuss the most common approach to evaluate your yearly salary.

How most freelancers calculate their hourly rate

To answer how much an annual salary of $45,000 equates to an hourly wage, most freelancers make the common pitfall of merely dividing their salary by the number of hours worked each year. There are 2,080 working hours per year if we assume that a freelancer works 8 hours weekly.

Here’s how calculations are usually made:

- Determine the standard number of hours worked per year: 2,080

- $45,000 desired salary / 2,080 hours = around $21.6 per hour

The math here is sound, but the method needs rethinking. If you aim to make $45,000 a year and charge only $21.6, you’re making the massive mistake of not considering the expenses involved in running your business.

Ask yourself: are you considering the fees required to make money? Even if you pad your rate and add an extra 20% to cover additional expenses, you risk becoming unprofitable.

Making $45,000 a year in gross income (without expenses subtracted) is worlds apart from actually taking home $45,000 in profit. To make $45,000 in net income requires a more thorough calculation of expenses.

To accurately set your hourly wage, our Freelance Hourly Rate Calculator considers all freelancing expenses, including sales, travel, marketing, software licenses, platform fees, business development, and days off per year. Here’s how to use it.

The right way to calculate your hourly rate

STEP 1: Access the Freelancer Nomads Freelance Hourly Rate Calculator

While full-time workers get the convenience of having an accountant to help them sort their finances, freelancers are left alone to figure things out. So how much is $45,000 a year in hourly gross pay? Without considering expenses, we’ve arrived at $21.6 per hour in gross pay.

Our Freelance Hourly Rate Calculator automatically assumes that a freelancer will work 8 hours a day on weekdays for forty weeks for 2080 hours a year. To help you reach your desired annual freelance income, the calculator will factor in your business expenses, which include business development, software, marketing, health insurance, and paid vacation time off.

Since our calculator considers your expenses, we can expect an amount far greater than $21.6 per hour. Most freelancers are oblivious to the many overhead costs associated with the freelance lifestyle, and the results may surprise you.

PRO TIP: Freelance calculators will give you an hourly wage based on your expenses to generate profit and support your desired quality of life. However, they won’t account for the value that you can provide to your clients.

A freelancer with five years of experience will charge much more than someone newly entering the market. A freelancer with an in-demand skill would charge higher than someone with a less-demand skill. Rates are complicated, and we understand that.

Therefore, when using our calculator, don’t take the results literally. Study your market value and see how a freelancer of your caliber should charge, then use the results from our calculator as a baseline for determining an honest rate – one that’s not only fair for you but also for the client.

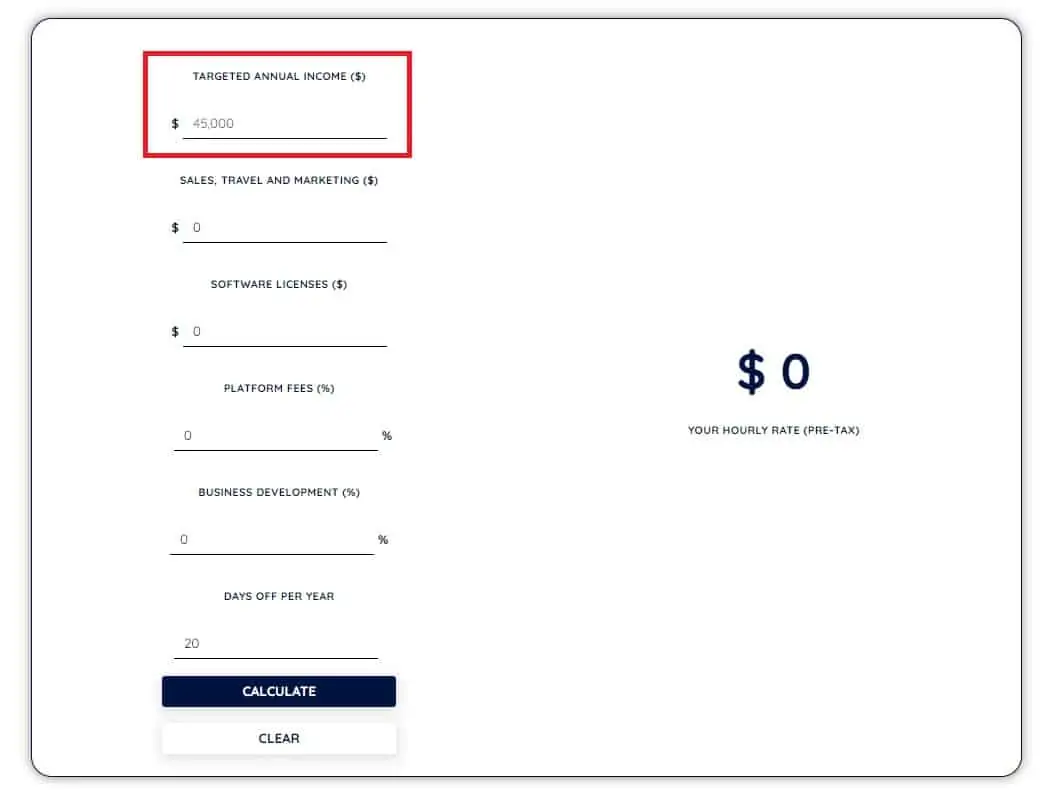

STEP 2: Input Your Desired Annual Salary

How much do you want to make as a profit per year? Input the income you want to pocket after all expenses have been subtracted.

Let’s add $45,000 here as an example.

PRO TIP: Be fair about your desired net income. One of the pitfalls of setting your rate is coming up with an unrealistic amount. You’ll be hard-pressed to find a job if your desired income is $100,000 as a neophyte freelancer.

Before finding out how much $45,000 a year hourly, be aware of your market value to better determine a fair profit.

See Related: 5 Ways to Get Paid to Make Spreadsheets

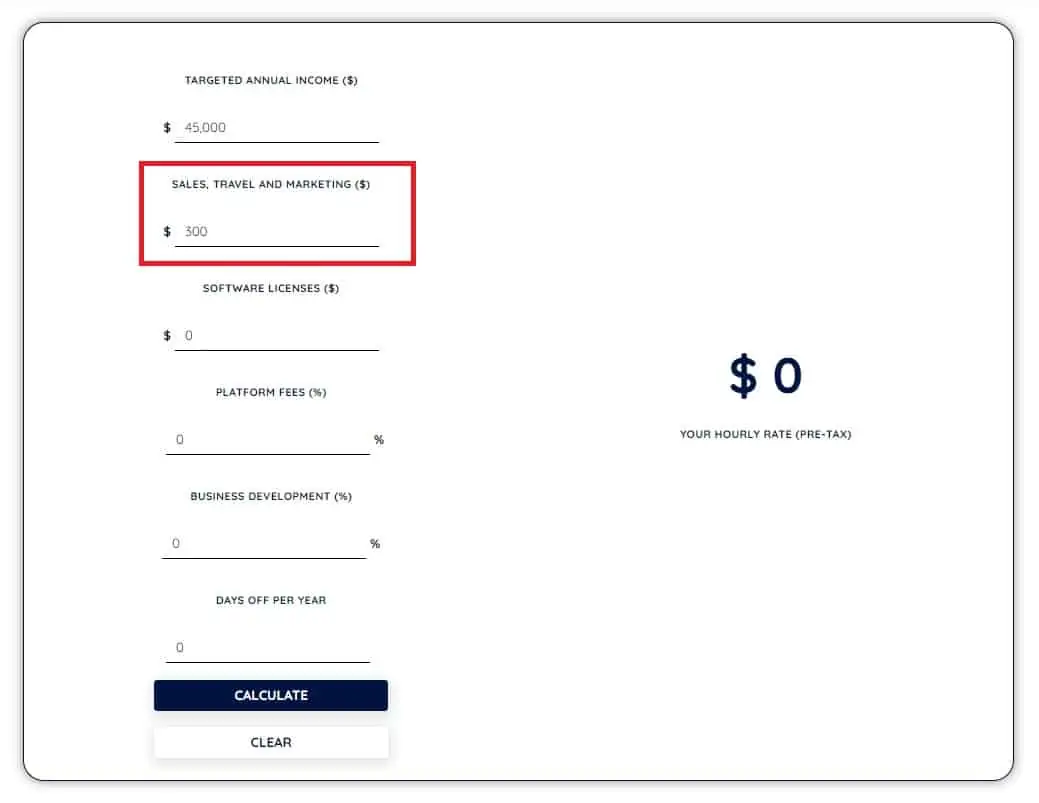

STEP 3: Input your Sales, Travel, and Marketing Expenses

Lump your sales, travel, and marketing expenses together on the third box. If your freelance job requires traveling, your travel expenses should include approximate expenses for travel accommodation, flights, and living allowances while traveling.

Also include your sales, advertising, promotions, and other marketing expenses. A freelance writer who travels to a nearby coffee shop for work three times a week may have travel expenses of around $300 a year. Let’s include that amount in the calculator.

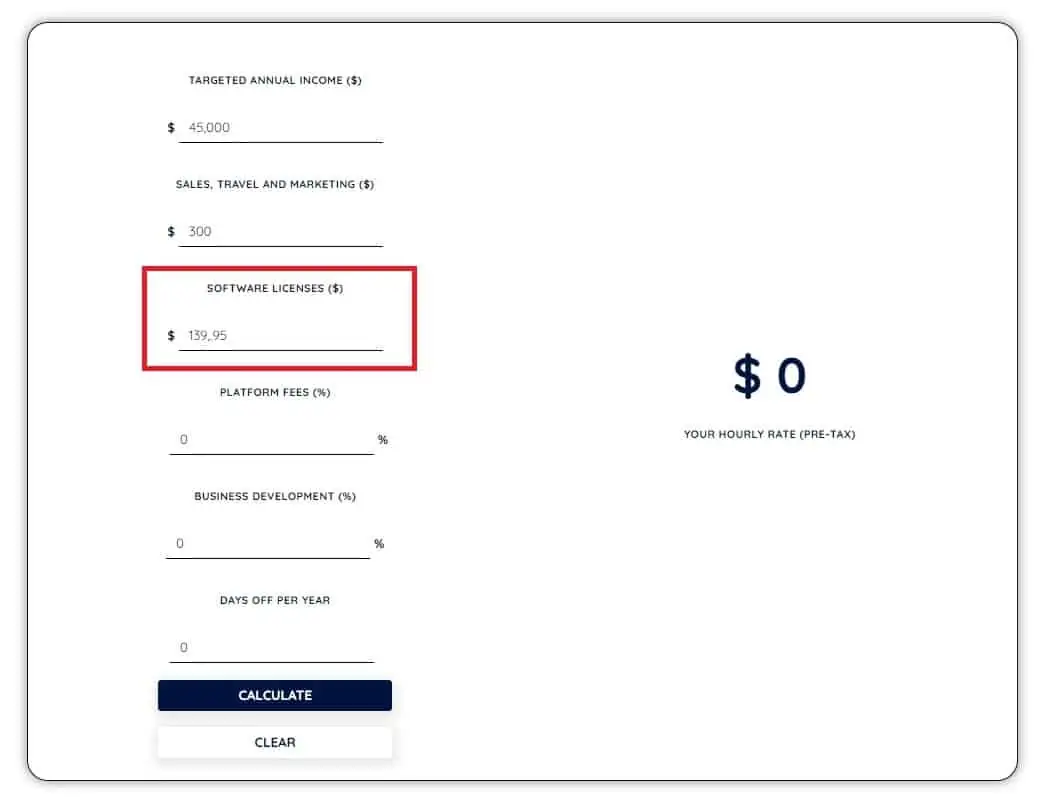

STEP 4: Input Software/License Expenses

To perform your work to the highest standards, you should use the best software available. If you’re a graphic designer, this may include expenses for the latest Adobe Suite.

If you’re a freelance writer, you’re probably subscribed to an editing or proofreading tool like Grammarly. If you’re handling your back-office accounting independently, you may use Quickbooks. Find out how much you spend on your software and lump them all together in this section.

A freelance writer subscribed to Grammarly will dole out $139.95 per year. Let’s add that in.

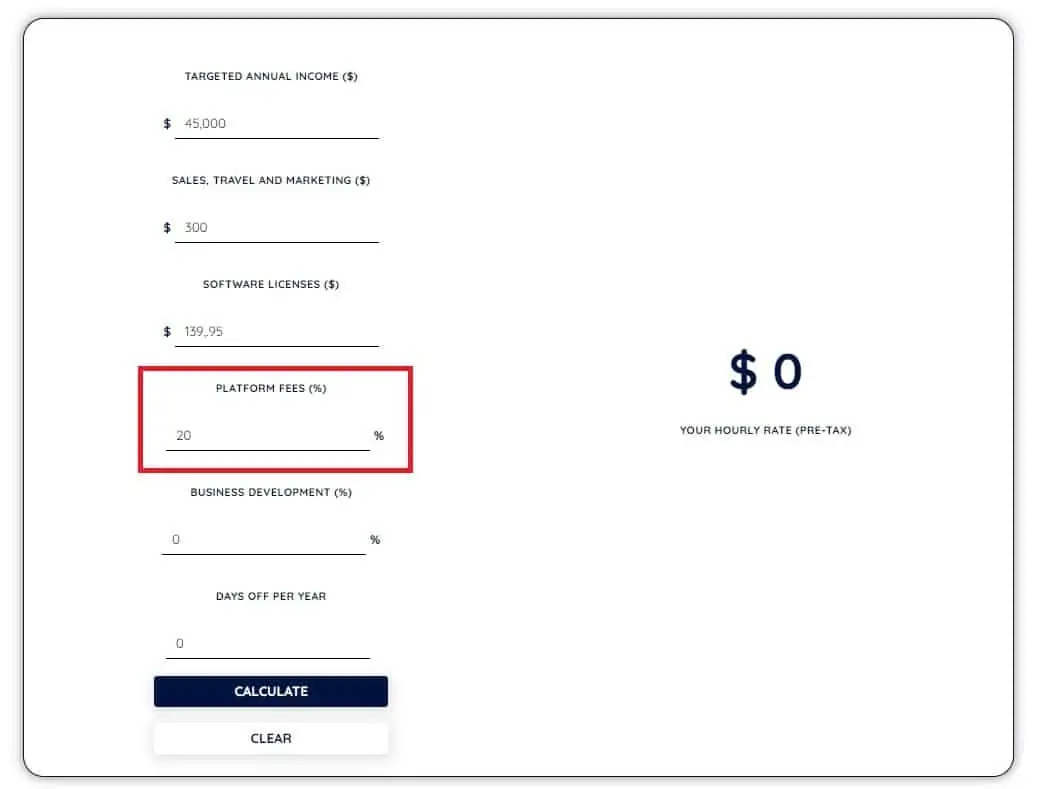

STEP 5: Determine your platform fees

Most freelance platforms skim a certain amount from your earnings as commission. They may take as much as 20% off your hourly rate or charge a fixed fee for using their service.

Estimate how much you pay platforms for their services, and input your platform fees on the box provided.

PRO TIP: Upwork charges 20% for your first $500 billed client and 10% for billing between $500.01 and $10,000. For earnings that exceed $10,000, the platform charges 5%.

Fiverr, on the other hand, takes 20% of your earnings for every job you complete. Compare the platform fees of the best freelance sites, or better yet, take our quiz to determine the best freelance site for you.

A freelance writer with an Upwork client will be charged 20% of his hourly earnings for service fees. Let’s add that in.

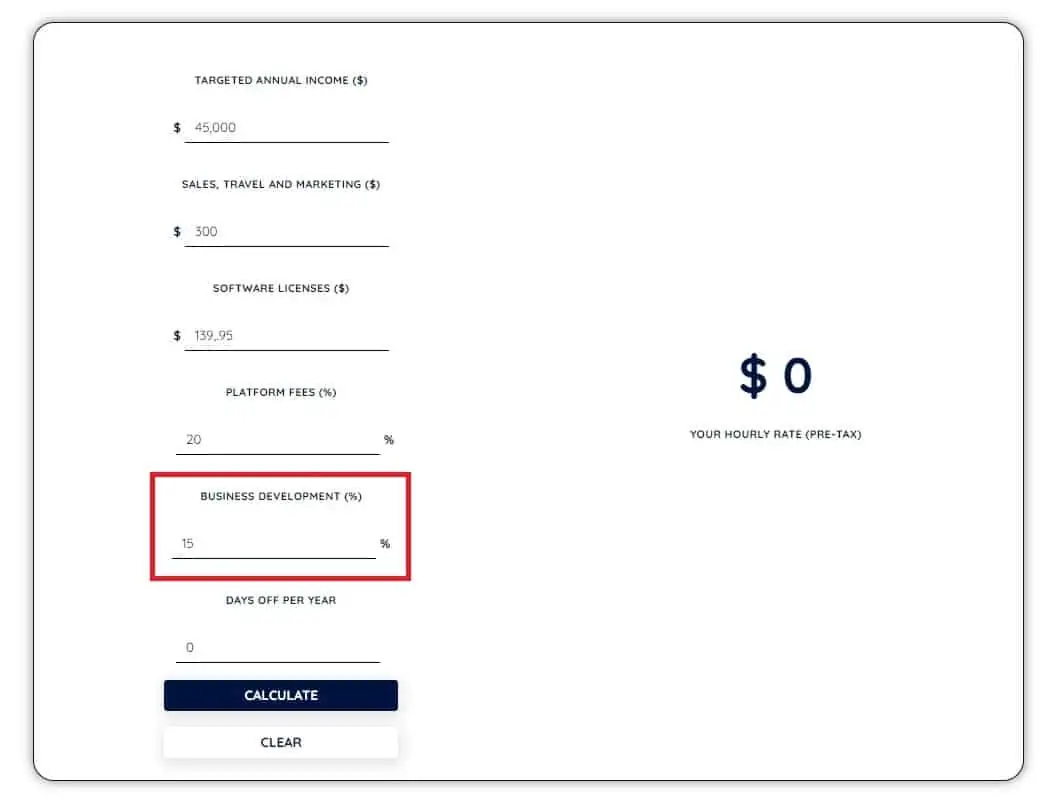

STEP 6: Calculate your business development hours in percentage

Before you can answer how much $45,000 a year is your hourly salary, you must figure out your non-billable hours throughout the year. Your non-billable time is when you spend trying to land more clients.

This includes browsing through freelance platforms and emailing new prospects – all endeavors related to ensuring you have a consistent client base. Estimate the percentage of time you spend generating new business and add it to the box provided.

A freelance writer will likely spend 15% of his time managing business development. Let’s include that in the calculator.

See Related: 8 Easy Freelance Jobs

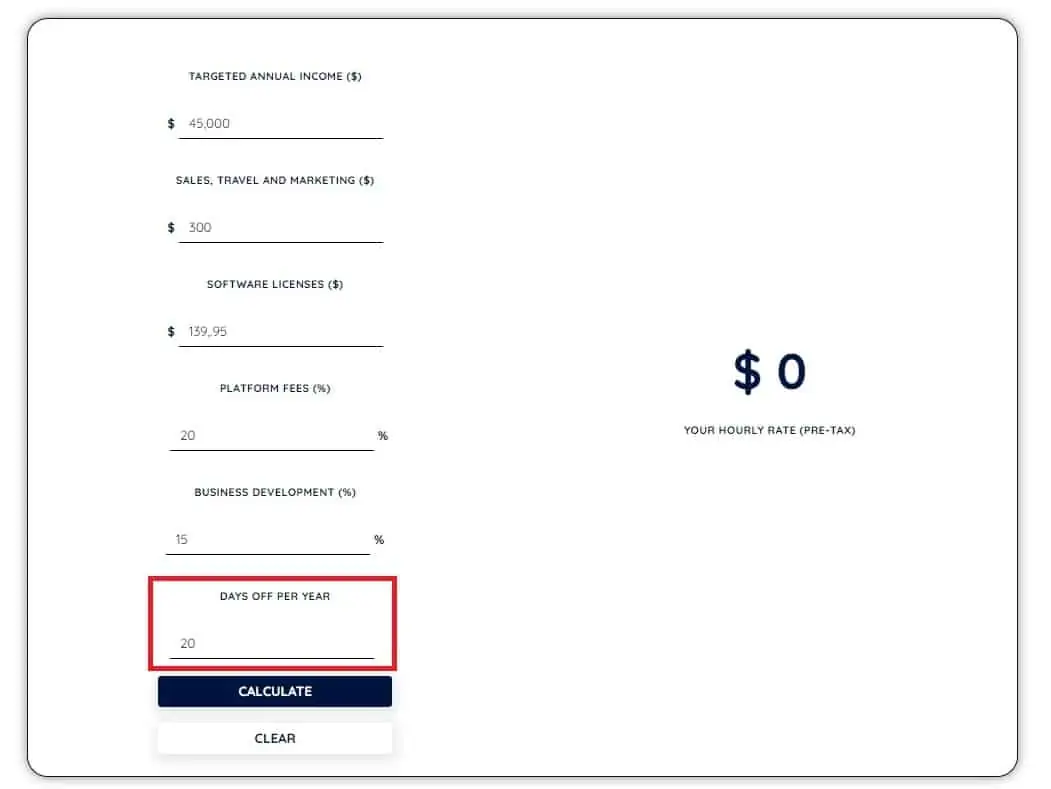

STEP 7: Input your paid time off

Freelancers need time to rest, too, so for good measure, including your paid time off. Estimate how many days in a year you intend to take time off and add it to the box provided.

A freelance writer may want overtime pay or to spend 20 days a year as paid time off. Let’s add that in.

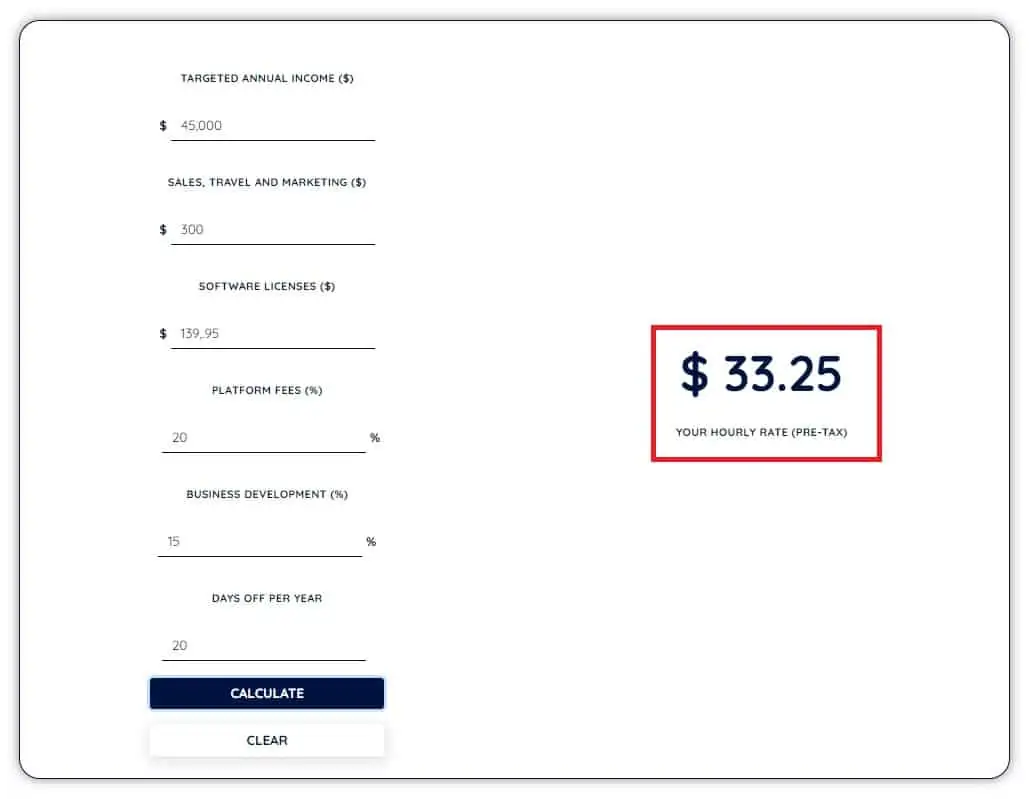

STEP 8: Arrive with your hourly wage

Using weekly salary for our freelance writer as an example, we can now answer how much $45,000 a year hourly. After clicking on “calculate,” we’ve arrived at a suggested hourly wage of $33.25 per hour. Compare that with our initial $21.6 per hour calculation – that’s an $11.65 difference.

It becomes apparent how easy it is for companies to undervalue our services. If you aren’t aware of the hidden costs associated with being your own boss, it can be ridiculously easy to underprice.

The next steps to take to determine an optimal hourly wage

Now that you know how much to charge hourly to live a comfortable life, what’s the next step?

Consider your state and federal income tax

An important consideration is factoring in your state and federal income tax liability as well as any other potential expenses for your freelance business since these taxes can reduce your total gross pay.

Finally, suppose you are working professionally or with clients who require special qualifications. In that case, it may be important to consider setting higher rates that reflect the value of your skills and experience.

You need to finalize an estimated after-tax income to help you determine if you are making enough to support your lifestyle because, ultimately, this is what your actual take-home pay is that will go directly to your bank account.

The problem with this side of things is that the tax rate can depend significantly on household income, family status, location, and many other factors. This gross pay for a yearly salary is around the median household income.

Compare this rate with the average market value.

Do your homework and compare your new hourly wage with how much freelancers of your caliber charge. Is this rate less or more? If you’re overcharging, you’ll find it difficult to land new clients, as the competition will overshadow you.

Remember, it’s better to land clients with a fair price than end up with none due to a bloated rate. If you’re charging less, you’ll end up being unprofitable. Adjust your calculated rate to remain attractive to potential clients, even if that means a little give and take.

See Related: Can You Do Freelance Work on an H4 Visa?

Apply this rate in all the ways you do business.

Now that you know your hourly wage, you have a new perspective on how much you’re worth. If you’re charging a fixed price per project, ask yourself:

How many hours will I spend working on this project, and does it align with my hourly wage? If it doesn’t, adjust accordingly. This will help you manage your monthly budget and income taxes so you ensure you are still getting compensated in line with your expectations,

If you charge based on value, your calculated hourly wage should show how your value-based rate will account for your expenses. You can factor in your newfound calculation in how you do your business.

See Related: How to Register as a Freelancer

Periodically reassess your rates.

Review your expenses and compare them to the rates you’re charging at least once a year. While reassessing, determine if a rate increase is in order.

Letting your clients know you reassess your rates annually before accepting a project. This helps prepare your clients for the possibility that you may increase your rates sometime in the future.

Use your newfound knowledge in negotiation.

Most clients are unaware of the expenses a freelancer incurs from their service, including the software you use, transportation costs, printing documents, or a cell phone plan.

Use the knowledge of your expenses as leverage when negotiating your rate with a client. Let your potential clients know that your asking price is warranted due to the expenses you’ll incur. Explain that making money as a freelancer can be costly and that your rates are set to help cover those expenses.

FAQs

$45,000 a year is how much an hour?

To calculate the hourly rate for a salary of $45,000 annually, divide the annual salary by the number of hours worked in a year. Assuming you work 40 hours per week and 52 weeks in a year, that would equate to 2,080 hours (40 x 52). When divided by 2,080, $45,000 equals an hourly rate of $21.63 per hour.

How much is a salary of $45,000 per year after taxes?

The amount of money you take home after taxes depends on your tax bracket and any deductions or credits you may be eligible for. Generally speaking, though, someone earning $45,000 annually can expect to take home around $35,000 after taxes. This amount will vary based on location, marital status, and other factors. It’s also important to remember that federal and state income tax are only two of the taxes you may be responsible for – there are also Social Security and Medicare taxes, which can reduce your total take-home pay even further.

What are some factors to consider when setting an hourly rate?

When setting your hourly rate, it’s important to consider the market rate for your particular job in your geographic area. You should also consider what you need to make to cover your expenses (including taxes) and have enough left over for savings or other needs. Additionally, if you’re working as a contractor or freelancer, you must also factor in the value of your time and expertise. Finally, it’s always a good idea to set a rate that allows you to be competitive with similar professionals in your field.

Related Articles

- Easy, Proven Ways to Sell Your Skills Online

- What is Freelance Work? – 7 Key Things to Know

- Best Time Tracking Apps for Freelancers